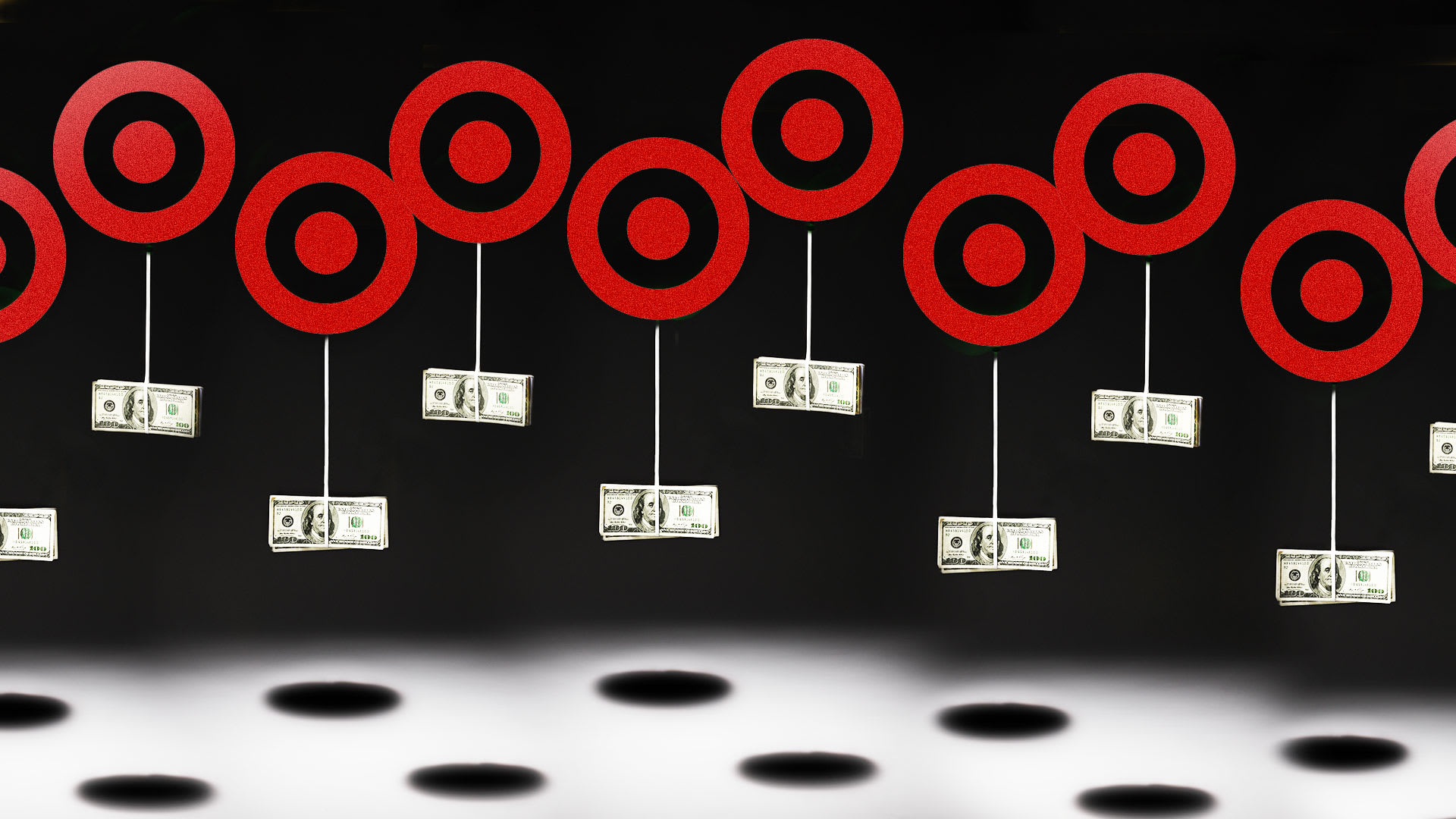

Target Stock Plummets: What Happened And What It Means For Investors

It’s official folks, Target stock has taken a nosedive, and everyone’s buzzing about it. If you’ve been keeping an eye on the financial markets, you’ve probably noticed the red flags popping up all over the place. The retail giant’s stock price has plummeted, leaving investors scratching their heads and wondering what went wrong. But here’s the deal—this isn’t just some random hiccup. There’s a whole lot more to the story than meets the eye.

When Target stock takes a hit, it’s not just a blip on the radar. It’s a major wake-up call for investors, analysts, and anyone who’s been betting big on the retail sector. The question on everyone’s mind is, “What happened?” Well, buckle up, because we’re about to dive deep into the world of stocks, markets, and the forces that drive them. Whether you’re a seasoned investor or just starting out, this is a moment that could shape your financial decisions moving forward.

Let’s be real, though—stocks don’t just fall out of nowhere. There’s always a reason, and sometimes it’s a combination of factors. In this article, we’ll break down the key reasons behind Target’s stock plummet, explore the implications for investors, and offer some actionable advice for navigating turbulent market waters. So, let’s get to it!

- Groups Similar To The Temptations

- Southern Edison Outages

- Obamas Kalorama

- Barrow S House

- Mark Harmon Actor Biography

Understanding Target Stock Plummets: The Bigger Picture

First things first, what exactly does it mean when Target stock plummets? Well, imagine you’re holding a bunch of Target shares, thinking you’re sitting pretty. Then, all of a sudden, the value of those shares drops like a rock. That’s what we’re talking about here. But why does it happen? And more importantly, how does it affect you as an investor?

Here’s the deal: stock prices are influenced by a ton of factors, from company performance to market sentiment. When Target’s stock takes a dive, it’s usually because something big has gone sideways. Whether it’s poor earnings reports, supply chain issues, or even external factors like inflation, these things can send shockwaves through the market.

Key Factors Behind the Drop

Let’s take a closer look at the main culprits behind Target’s stock plummet:

- Go Kart Burnsville Mn

- Did Cameron Boyce Have A Sister

- East Village San Diego Bars

- What Does Adam Sandler S House Look Like

- Movie Splash Actress

- Poor Financial Performance: If Target’s quarterly earnings don’t meet expectations, investors start panicking. It’s like a domino effect—once the first tile falls, the rest follow.

- Supply Chain Challenges: You’ve probably heard about the global supply chain mess. Well, it’s hitting retailers hard, and Target’s no exception. Delays, shortages, and rising costs can all contribute to a stock price drop.

- Inflation and Rising Costs: When prices go up, consumers spend less. That means lower sales for Target, which translates to a hit on their stock price.

- Market Sentiment: Sometimes, it’s not about the numbers—it’s about how people feel. If investors lose confidence in Target, they start selling off their shares, driving the price down even further.

Why Target Stock Matters to You

Now, you might be thinking, “Why should I care about Target stock?” Well, here’s the thing—Target isn’t just any old company. It’s one of the biggest names in retail, and its performance can have a ripple effect across the entire industry. If Target’s stock plummets, it could signal bigger problems in the retail sector. And if you’re invested in other retail stocks, that’s something you need to pay attention to.

Plus, Target’s stock is a popular choice for many investors. If you’ve got shares in your portfolio, a sudden drop could mean big losses. Even if you don’t own Target stock, understanding what’s happening can help you make smarter investment decisions in the future.

What Does This Mean for Investors?

For investors, Target’s stock plummet is a wake-up call. It’s a reminder that the market can be unpredictable, and even the biggest companies aren’t immune to setbacks. Here’s what you need to do:

- Stay Informed: Keep an eye on financial news and reports. Knowing what’s happening in the market can help you make better decisions.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. If you’re heavily invested in retail stocks, consider spreading your investments across different sectors.

- Reassess Your Strategy: If Target’s stock plummet has you worried, it might be time to reevaluate your investment strategy. Are you taking on too much risk? Is it time to shift your focus?

Breaking Down the Numbers

Let’s talk numbers. When Target’s stock plummets, it’s not just a vague concept—it’s a measurable event. Here’s a breakdown of the key stats:

Recent Performance

Over the past few months, Target’s stock has seen some serious volatility. Here’s a quick snapshot:

- Stock price dropped by 20% in the last quarter.

- Earnings per share (EPS) missed estimates by a wide margin.

- Revenue growth slowed significantly compared to previous quarters.

These numbers don’t lie. They paint a clear picture of a company facing some serious challenges. But what’s driving these numbers? Let’s dig deeper.

The Role of External Factors

It’s not all on Target’s shoulders. Sometimes, external factors play a big role in stock price movements. Here are a few key players:

Inflation

Inflation has been a hot topic lately, and for good reason. Rising prices mean higher costs for companies like Target. When costs go up, profits go down. And when profits go down, stock prices follow suit.

Supply Chain Issues

The global supply chain mess has been wreaking havoc on businesses everywhere. For Target, it means delays in getting products to shelves, higher costs for shipping and logistics, and ultimately, lower sales. It’s a perfect storm of bad news for investors.

What the Experts Are Saying

So, what do the experts think about Target’s stock plummet? Well, opinions vary, but there are a few common themes:

Analyst Opinions

Many analysts are pointing to a combination of factors, including poor financial performance, supply chain issues, and inflation. Some are urging caution, advising investors to hold off on buying Target stock until the dust settles. Others are more optimistic, seeing this as an opportunity to buy low.

Investor Sentiment

Investor sentiment is another key factor. Right now, a lot of people are feeling uneasy about the market in general. That’s contributing to the sell-off in Target stock. But sentiment can change quickly, so it’s important to keep an eye on the pulse of the market.

How to Navigate the Turbulence

So, what can you do to protect your investments during times like these? Here are a few tips:

Stay Calm and Collected

Panic selling is never a good idea. If you’re holding Target stock, take a deep breath and assess the situation. Is this a temporary dip, or a sign of bigger problems? Make decisions based on facts, not emotions.

Do Your Research

Before making any moves, do your homework. Look at Target’s financials, read analyst reports, and consider the broader market trends. The more informed you are, the better equipped you’ll be to make smart decisions.

Consider Long-Term Strategies

If you’re in it for the long haul, don’t let short-term fluctuations derail your plans. Target’s stock might be down now, but that doesn’t mean it won’t recover. Consider whether this is a temporary setback or a sign of deeper issues.

Looking Ahead: What’s Next for Target?

So, where does Target go from here? That’s the million-dollar question. While the future is always uncertain, there are a few things to watch for:

Potential Recovery

Target has weathered storms before, and there’s a chance they’ll bounce back from this one. If they can address the issues causing the stock plummet, they might be able to regain investor confidence. Keep an eye on upcoming earnings reports and any announcements about changes in strategy.

Long-Term Outlook

In the long run, Target’s success will depend on its ability to adapt to changing market conditions. If they can find ways to cut costs, improve supply chain efficiency, and appeal to consumers despite rising prices, they might just come out on top. But it won’t be easy.

Conclusion: What You Need to Know

Target stock plummets are never fun, but they’re a fact of life in the world of investing. Whether you’re a seasoned pro or a newbie, understanding what’s happening and why is key to making smart decisions. Here’s a quick recap of what we’ve covered:

- Target’s stock plummet is driven by a combination of factors, including poor financial performance, supply chain issues, and inflation.

- External factors like market sentiment and broader economic trends also play a role.

- Investors need to stay informed, diversify their portfolios, and reassess their strategies in response to market changes.

So, what’s next? Well, that’s up to you. If you’re feeling confident, this could be an opportunity to buy low. If you’re unsure, it might be time to take a step back and reassess. Whatever you do, remember this—investing is a journey, not a sprint. Keep your eyes on the prize, and you’ll be just fine.

And hey, don’t forget to share your thoughts in the comments below. What do you think about Target’s stock plummet? Are you holding, selling, or buying? Let’s start a conversation!

Table of Contents

- Understanding Target Stock Plummets: The Bigger Picture

- Why Target Stock Matters to You

- Breaking Down the Numbers

- The Role of External Factors

- What the Experts Are Saying

- How to Navigate the Turbulence

- Looking Ahead: What’s Next for Target?

- Conclusion: What You Need to Know

- Key Factors Behind the Drop

- What Does This Mean for Investors?

Article Recommendations

- Anonymous Celebrity Lawsuit

- Arrowhead Stadium History

- Michael Jackson Home In Gary Indiana

- Jensen Danneel Ackles

- Luke Combs Brother Died

Detail Author:

- Name : Mathew Feil

- Username : zachery.torp

- Email : kulas.maryam@kovacek.net

- Birthdate : 1988-08-26

- Address : 280 Rolfson Manor Apt. 544 West Nico, IL 88190

- Phone : (341) 624-8427

- Company : Cruickshank-Auer

- Job : Professor

- Bio : Nesciunt quia esse doloremque minima non quia ea rerum. Asperiores quos optio molestiae excepturi mollitia autem molestiae.

Socials

facebook:

- url : https://facebook.com/maymie9439

- username : maymie9439

- bio : Omnis eum voluptatem excepturi vitae aut est iure. Eum repellat quia qui et.

- followers : 4891

- following : 697

linkedin:

- url : https://linkedin.com/in/maymie_vonrueden

- username : maymie_vonrueden

- bio : Qui minus eius ea quis dolorum.

- followers : 2229

- following : 103

instagram:

- url : https://instagram.com/maymie_vonrueden

- username : maymie_vonrueden

- bio : Voluptatem omnis esse id ipsam. Molestias sint sunt nesciunt accusamus. Et sunt nisi et alias.

- followers : 184

- following : 326

tiktok:

- url : https://tiktok.com/@vonruedenm

- username : vonruedenm

- bio : Et architecto quos sit explicabo et excepturi.

- followers : 3978

- following : 666